Innovate or die. This trendy saying is also applicable to the insurance industry, which is often perceived as conservative. Insurance is experiencing a significant shift towards innovation to meet evolving customer demands and emerging risks. For instance, the cyber insurance market is projected to grow exponentially, surpassing $22.4 billion by 2026.

The COVID-19 pandemic has hastened customer service digitalization, especially vital for insurers. Executives acknowledge innovation's role in long-term value and cost reduction, necessitating a systematic approach for sustainable growth. Despite this, many insurers struggle with innovation, hindering product development. Facing competition and changing markets, insurers need cross-cutting innovation, fully integrated into their structure, for effective competition and success against disruptions. We delve into innovation challenges and steps to establish an innovative culture in this article.

The Problem of Innovation

Innovation is often a mindset that requires disruption, boldness and willingness to replace what’s working and start over. This is the pposite to many well-established and successful insurance businesses' core values. However, the traditional insurance industry in North America is grappling with sluggish growth, struggling to keep up with GDP growth rates in developed markets. Shareholder returns have shown some recovery but remain inconsistent, and insurers' TSR performance has often lagged behind the financial sector as a whole in recent years.

That’s why many insurers have turned to the ultimate manifestation of innovation; startups, or, to a lesser degree, new business lines and alternative distribution. These ventures aim to address changing customer expectations, create fresh revenue streams, or shield against disruptive forces. However, their success has been limited, with insurance companies facing difficulties scaling new businesses compared to other sectors. and some insurtechs not focusing on profitability.

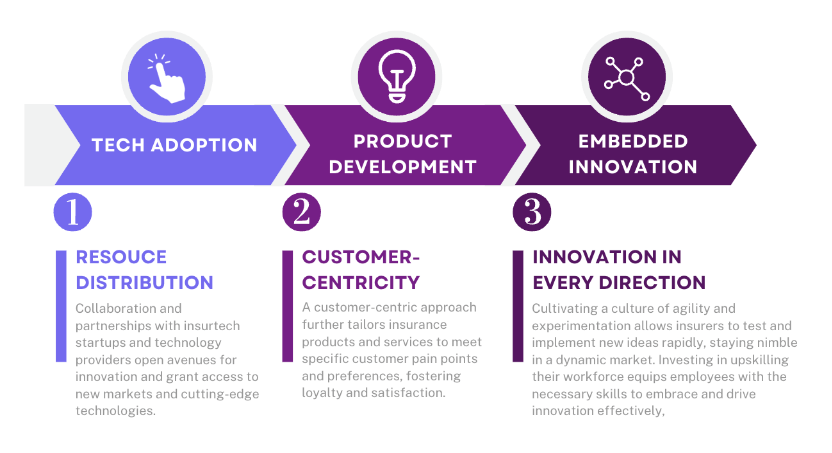

Despite the daunting outlook, there are ways for insurers to increase their chances of success. Firstly, they must identify existential challenges and redistribute resources from repetitive administrative tasks and simplify the underwriting process. Secondly, insurers must mitigate the risks associated with new ventures by streamlining product development. This proactive approach to building new products rapidly and sustainably will provide a foundation for long-term success in the dynamic insurance landscape. Thirdly, innovation should be embedded in every step of the way. By combining strategic focus and diligent execution, insurers can pave the way for sustainable growth and profitability in an ever-changing market.

Innovate or die:

In recent years, insurance companies have launched numerous new businesses, especially in the life and commercial sectors, aiming to tap into the growing trend of digitalization. MGA, Nexus Underwriting, just acquired Evolve Cyber Insurance Services LLC, an MGA based in California specializing in cyber insurance. Additionally, Aviva, a leading UK-based insurer, launched a digital platform called "Ask It Never," which aimed to simplify the claims process for customers and improve overall customer experience.

Evolving regulations, such as data privacy laws and climate-related risk assessments, require insurers to adapt their practices and develop compliant products. Leveraging technologies like artificial intelligence, blockchain, telematics, and big data analytics can empower insurers to improve various aspects of their operations, from underwriting and claims processing to risk assessment and customer engagement. Embracing innovation not only enhances operational efficiency, reducing administrative costs, but also enables insurers to meet the dynamic needs of modern consumers effectively.

Reasonable and viable ways to innovate:

- Collaboration and partnerships with knowledgeable insurtech startups and technology providers open avenues for innovation and grant access to new markets and cutting-edge technologies.

- A customer-centric approach further tailors insurance products and services to meet specific customer pain points and preferences, fostering loyalty and satisfaction.

- Cultivating a culture of agility and experimentation allows insurers to test and implement new ideas rapidly, staying nimble in a dynamic market. Investing in upskilling their workforce equips employees with the necessary skills to embrace and drive innovation effectively, ensuring the insurance industry remains at the forefront of progress and relevance.

Zooming in:

Redistribute resources from repetitive administrative tasks to transformative initiatives

Innovation comes in many shapes and forms, from bold ideas to advanced technology adoption and the mindset changes that follow. Yet, many traditional businesses prioritize business as usual, focusing on maintaining stability for customers amidst global disruption and uncertainty, such as the recent pandemic. However, business as usual just takes a lot of time, leaving limited resources for bold and potentially disruptive moves.

To overcome this challenge, insurers must reallocate resources from repetitive admin tasks to fuel potentially transformative initiatives. By adopting technology that automates manual work and reduces the room for human errors, insurance companies can stay ahead of the curve and focus on delivering outstanding work

Additionally, many insurance companies possess vast amounts of data locked in legacy systems or paper files. By rapidly building capabilities to mine this data, insurers can identify and respond to customer trends more effectively, leading to identifying loss trends and a more resilient distribution mechanism.

By embracing innovation, reallocating resources, and leveraging data, insurance companies can position themselves for future success and overcome the challenges of an ever-changing marketplace.

Streamline product development

Managing an innovation portfolio requires insurance organizations to adopt distinct pathways for product development, each with its own specific characteristics and risk profiles. One pathway involves derisking, where the innovation may compete with a part of the core business and carries high risk but potentially high returns. Another approach combines derisking with acceleration, utilizing new technologies and capabilities and necessitating significant cross-business unit collaboration and change management. Additionally, there is the accelerating pathway, which involves known solutions and use cases but may have limited cross-BU implications and delivery capabilities.

Insurance companies should rigorously plan and test their innovation ventures, starting with constructing a detailed economic model and setting specific revenue goals. By reverse-engineering the assumptions underlying these goals, insurers can identify the most critical and uncertain factors that need testing. Armed with this information, they can allocate resources to early prototyping and development to assess the viability of their innovation initiatives effectively.

Creating distinct product-development processes and evaluating risk/return profiles enable insurers to balance their innovation efforts effectively. While some products may require significant derisking and cross-business collaboration, others may have known solutions and can be accelerated to achieve the desired speed to market.

Encourage innovation every step of the way

Innovation is a mindset, not a framework. To ensure the success of innovation initiatives, insurance companies must fully integrate their innovation teams into the business planning cycle. This integration is essential to establishing clear near-term metrics for success, understanding the critical role of innovation in overall enterprise success, and creating seamless links with other parts of the organization for effective implementation and scaling of innovations. Not every team player needs to be an innovator, but there must be constant and open dialogue between innovation and business teams, insurers can develop a common understanding of the market landscape and identify potential opportunities.

By maintaining a dynamic pipeline of ideas and aligning innovation goals with overall financial plans and individual executive accountabilities, insurers can foster a culture of innovation that drives sustainable growth and long-term success.

In conclusion

The insurance industry faces the imperative to innovate due to evolving customer demands and emerging risks. The shift towards innovation is evident in the rapid tech adoption and the digitization of customer services, accelerated by the COVID-19 pandemic. However, many insurers struggle to fully integrate innovation into their business-planning cycle, hindering their success in scaling new ventures. To overcome this, insurers must redistribute resources, streamline product development, and embrace innovation at every step, fostering a culture of innovation for sustainable growth and competitiveness in a dynamic market. Collaboration, customer-centricity, and agility are key elements to driving successful innovation in the insurance industry.

If you’re ready to see these systems in action, book a demo with DataCrest and evaluate how this tech can streamline your business in less time than expected.